Text by Doug Wootton, Sport journalist.

If you're looking at making money online and can't decide between day trading and value betting, then look no further.

With the right knowledge and application, both can offer a substantial investment but crucially you must decide which is best for you.

Before getting into expected value, variance and weighing up trading platforms and currency exchanges, let's go over the basics. Soon you will be able to see which is the best investment for you.

Day trading

What is day trading?

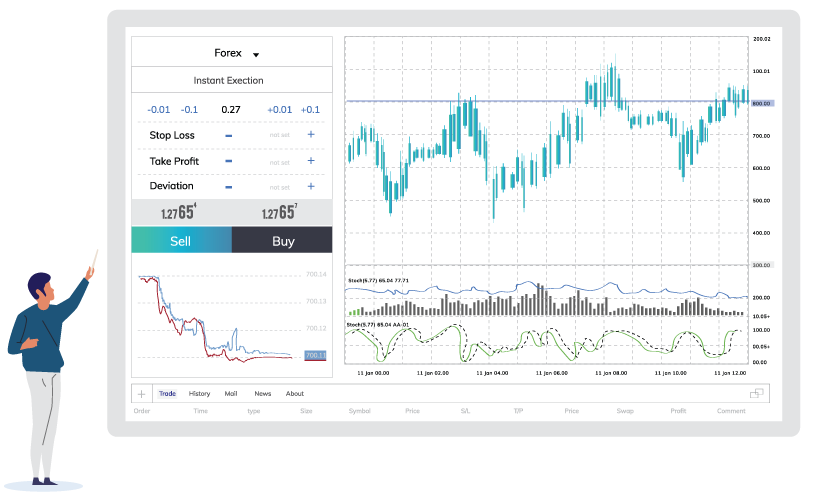

Day trading is a relatively new form of speculative trading made possible through the internet revolution. It allows regular members of the public to trade with their own money on one of many platforms – something that previously only brokers and financial institutions were exclusively able to do. Any purchase and sale of a security within a day is considered as an act of day trading.

It is viewed with trepidation by traditional investors, partly because it's the 'new kid on the block', but also down to the 'get rich quick' connotation it has accumulated, as some shady online companies have exploited those with a lack of knowledge into blindly parting with their cash, offering little to no return.

What are the most popular forms of day trading?

The Foreign Exchange, also known as Forex or FX, has become synonymous with day trading. Stock markets are also traded, but Forex trading remains the most popular.

How does day trading work?

As the FX is the most popular, it's best to focus on this market. In short, trading on the Forex consists of betting on the increase/decrease of a currency against another currency, which can be done 24 hours a day, 5 days a week. This can be done with an app, browser or software and is right now literally clicks away on your phone/laptop.

As can be expected, day traders focus on short-term market moves.

There are hundreds of techniques used by traders, some fundamental ones include trading the news – responding to corporate changes/earnings, international and national conflicts, key economic stats released, polls, government announcements etc. These sudden changes often lead to swings in the market, resulting in profit/loss.

Others get more sophisticated using bespoke software which place trades automatically, known as High Frequency Trading – however this is better suited for an advanced trader.

How much money can you make day trading?

As you may expect, there is no set formula for Return on Investment (ROI). Your bankroll, ability to read markets and event consequences, dedication, resolve, technique and ultimately luck will be a big deciding factor in whether you make thousands a month or lose your bankroll in days.

Truth is most traders consistently lose (some studies show that around 90% lose), but that doesn't mean you can't be in the 10% of traders that win. Most trading platform offer paper trading (fake money) to trade with initially so you get an idea of where you're at. This is highly advisable for all forms of trading for beginners – it's not the type of thing you dive into and unfortunately there are lot of companies ready to take your money to give you tips, which shouldn't be trusted.

Those traders making money usually make a yield (profit per pound staked) of around 1% to 5% a month, but as all traders will know volatility is part and parcel of trading and you must be able to take the rough with the smooth.

Value betting

What is value betting?

Value betting is when there is the option to profit off odds of an event which don't reflect the true probability of an event (there's plenty more information on value betting here).

A simple way to grasp the concept of this is if let's say Man City play Grimsby (Man City being one of the best teams in the world against a lower tier English side) and Man City were to be given odds 2/1 or 3.00. i.e. you place £1 and should Man City win which you'd almost guarantee to happen, you'd get your £1 stake back and £2 from the bookmaker, like printing money.

Now not all value betting options are as clear cut as this, but when you start seeing the probability of an outcome against whether the odds accurately reflect this or not, is where you begin to see value betting investment options. Obviously not every bet will win, which is why volume is important.

Key terms in value betting include expected value (what can you expect to win per bet), real value (the actual profit/loss of a bet), variance (difference between the expected value and real value), but there is a load more of information on value betting here.

What are the most popular forms of value betting?

Any markets which are available for regular betting. Value betting is usually targeted on traditional win/lose/draw markets in football, or winners of games in other sports.

Ultimately it can be any sport or market where the value bettor is confident that they have an edge over the bookmaker's odds, whether it's from data, sharp book odds, information or other means to decide that the odds don't reflect the probability of the outcome.

How much can you make value betting?

As with day trading, there is no set formula for ROI as bankroll, frequency of bets and luck plays a part – some months will be more fruitful that others.

Unlike day trading, there are platforms which can legitimately identify value bets to take out the hours of work required to find them yourself. This can obviously increase the amount of value bets you can place.

The ValueBetting service has shown to make an average yield of 3%. Ultimately, it is up tp you to choose which is the best investment. But if we were to give you a little hint on which method is the most fun – then value betting is the way to go.

Curious to see real results from ValueBetting users? Join the RebelBetting community.

Subscribe today

Start using the fastest, most user-friendly, value betting and sure betting service on the market. At any given time, RebelBetting finds thousands of profitable bets for you to bet on.

P.S. To get the best possible offer make sure you join for a longer period of time – up to 30% off.

RebelBetting Pro

- Value bets & sure bets

- Maximize your profit

- The most profitable bets

- Access non-limiting bookies

RebelBetting Starter

- Value bets & sure bets

- Great when starting out

- ROI over 30% / month

RebelBetting Pro

- Value bets & sure bets

- Maximize your profit

- The most profitable bets

- Access non-limiting bookies

RebelBetting Starter

- Value bets & sure bets

- Great when starting out

- ROI over 30% / month

Day trading vs value betting comparison

| Day trading | Value betting with ValueBetting service | |

|---|---|---|

| Required bankroll | £500 to 100,000 | £200 to 10,000 (+ money for the cost of having a subscription) |

| Average time (per trade/bet) | 10 to 180 minutes | 20 – 60 seconds |

| Monthly yield | 0-5% | 1-5% |

| Prior knowledge | Extesive prior knowledge | Low prior knowledge |

| Potential winning per month | Up to £10,000 | Up to £5,000 |